Vavada Casino — это онлайн-платформа для азартных игр, которая предлагает игрокам широкий выбор игр казино. Благодаря удобному интерфейсу и разнообразию опций Vavada Casino стремится обеспечить увлекательный и захватывающий игровой процесс. Игроки могут заходить в казино с настольных компьютеров или мобильных устройств, что делает его удобным и доступным, где бы они ни находились.

Vavada casino

100% бонус в казино Кэшбэк 10% 100 Фриспинов в подарокVavada официальный сайт

Vavada casino

100% бонус в казино Кэшбэк 10% 100 Фриспинов в подарокVavada официальный сайт Vavada casino

Приветственный бонус за регистрацию Актуальное зеркало Вход на сайт сейчасВход на зеркало Vavada

Vavada casino

Приветственный бонус за регистрацию Актуальное зеркало Вход на сайт сейчасВход на зеркало Vavada Vavada casino

Бонус до 1000$ 100 бесплатных вращений Бонус в Андройд приложенииЗабрать Бонус Вавада

Vavada casino

Бонус до 1000$ 100 бесплатных вращений Бонус в Андройд приложенииЗабрать Бонус Вавада

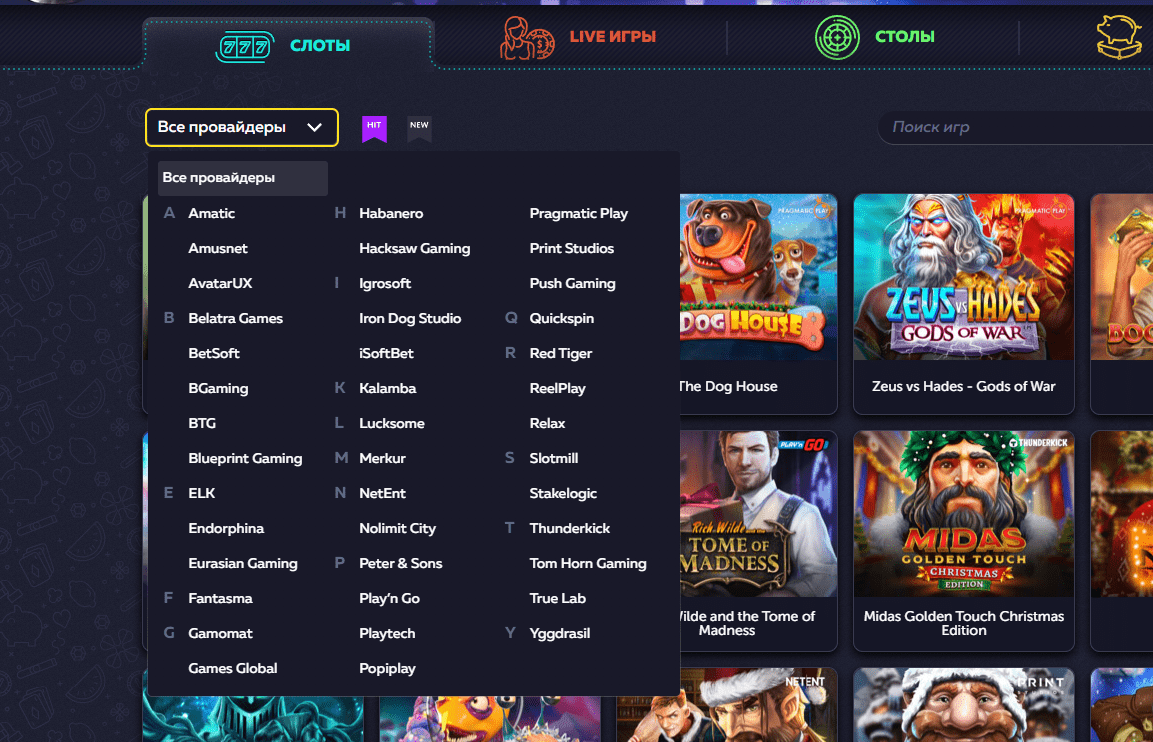

Vavada Casino предлагает широкий спектр игр казино на своей онлайн-платформе, предоставляя игрокам разнообразный выбор. Благодаря удобному интерфейсу и разнообразным опциям Vavada Casino стремится обеспечить увлекательный и захватывающий игровой процесс. Независимо от того, предпочитают ли игроки заходить в казино со своих настольных компьютеров или мобильных устройств, оно остается удобным и доступным независимо от их местонахождения.

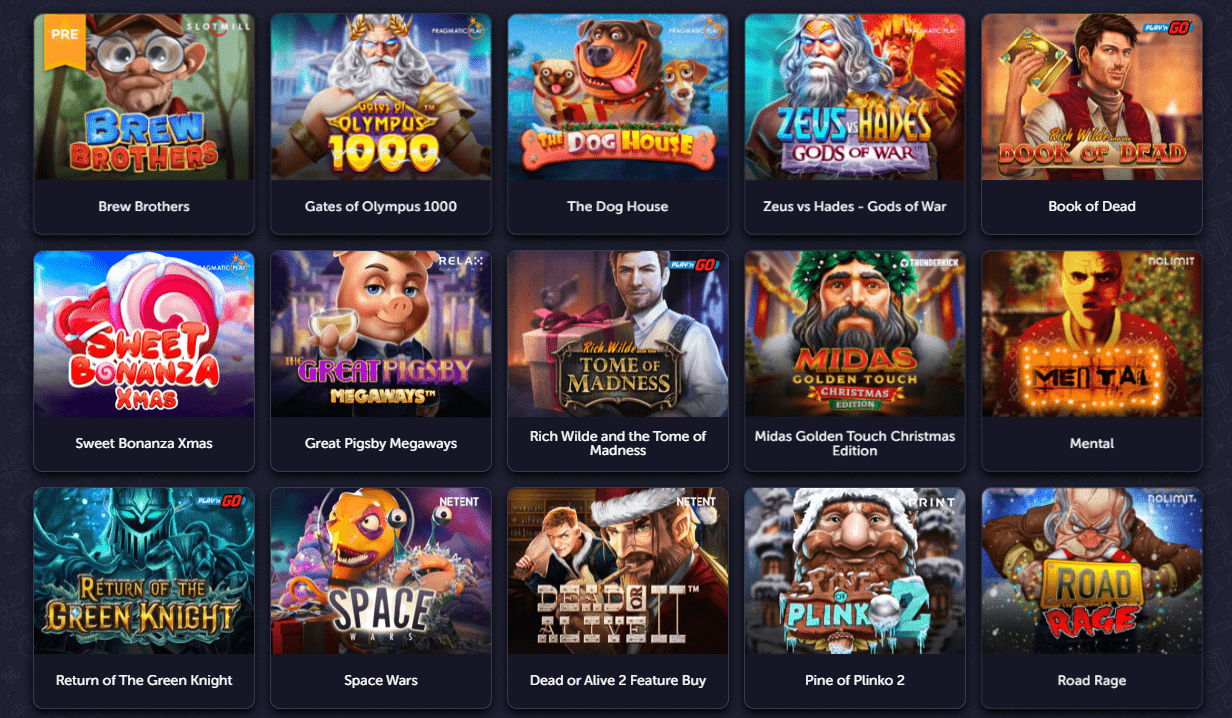

Выбор игр в Vavada Casino

В казино Vavada игроки могут насладиться широким разнообразием игр, включая слоты, настольные игры и игры в живом казино.

- Слоты: Vavada предлагает огромный выбор игровых автоматов, включая классические слоты, видеослоты и слоты с прогрессивным джекпотом. Эти игры основаны на различных темах, отличаются привлекательной графикой и захватывающими бонусными функциями. Благодаря различным линиям выплат и вариантам ставок игроки могут выбрать слот-игру по вкусу и вращать барабаны, чтобы получить шанс на крупный выигрыш.

- Настольные игры: Казино Vavada также предлагает ряд традиционных настольных игр, таких как блэкджек, рулетка, баккара и покер. Эти игры обеспечивают классический опыт игры в казино и рассчитаны на игроков разного уровня подготовки. Независимо от того, опытный вы игрок или начинающий, вы сможете насладиться азартом и стратегией, задействованными в этих настольных играх.

- Игры в живом казино: Раздел живого казино Vavada позволяет игрокам испытать азарт игры в реальном казино, не выходя из дома. Игры казино транслируются в режиме реального времени и проводятся профессиональными дилерами. Игроки могут взаимодействовать с дилерами и другими игроками, создавая захватывающий и социальный игровой опыт. Среди популярных игр казино Vavada — живой блэкджек, живая рулетка, живая баккара и живой покер.

Vavada casino

100% бонус в казино Кэшбэк 10% 100 Фриспинов в подарокVavada официальный сайт

Vavada casino

100% бонус в казино Кэшбэк 10% 100 Фриспинов в подарокVavada официальный сайт Vavada casino

Приветственный бонус за регистрацию Актуальное зеркало Вход на сайт сейчасВход на зеркало Vavada

Vavada casino

Приветственный бонус за регистрацию Актуальное зеркало Вход на сайт сейчасВход на зеркало Vavada Vavada casino

Бонус до 1000$ 100 бесплатных вращений Бонус в Андройд приложенииЗабрать Бонус Вавада

Vavada casino

Бонус до 1000$ 100 бесплатных вращений Бонус в Андройд приложенииЗабрать Бонус Вавада

В целом, казино Vavada предлагает разнообразный и полный выбор игр, от классических слотов до традиционных настольных игр и живого казино. Независимо от того, предпочитаете ли вы вращать барабаны, проверять свои навыки в настольных играх или участвовать в живых действиях казино, Vavada предлагает что-то для каждого типа игроков.

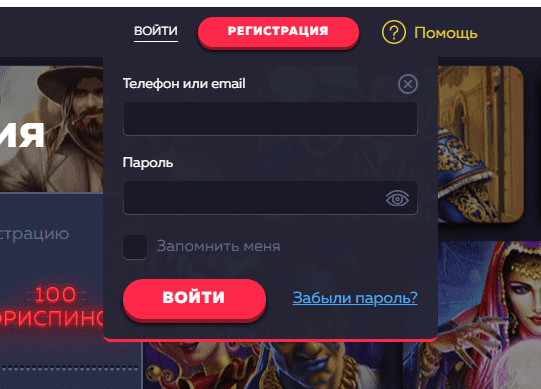

Как играть на деньги в Vavada Casino

Чтобы играть на деньги в казино Vavada, выполните следующие действия:

- Зарегистрируйте аккаунт: Зайдите на сайт Vavada Casino и нажмите на кнопку «Зарегистрироваться» или «Sign Up». Заполните необходимую информацию, включая имя, электронную почту, пароль и другие необходимые данные.

- Пополните счет: После того как ваш аккаунт будет успешно создан, вам необходимо внести деньги на свой счет в казино. Vavada Casino предлагает различные способы оплаты, такие как кредитные/дебетовые карты, банковские переводы, электронные кошельки и криптовалюты. Выберите наиболее удобный для вас вариант и следуйте инструкциям, чтобы внести средства на счет.

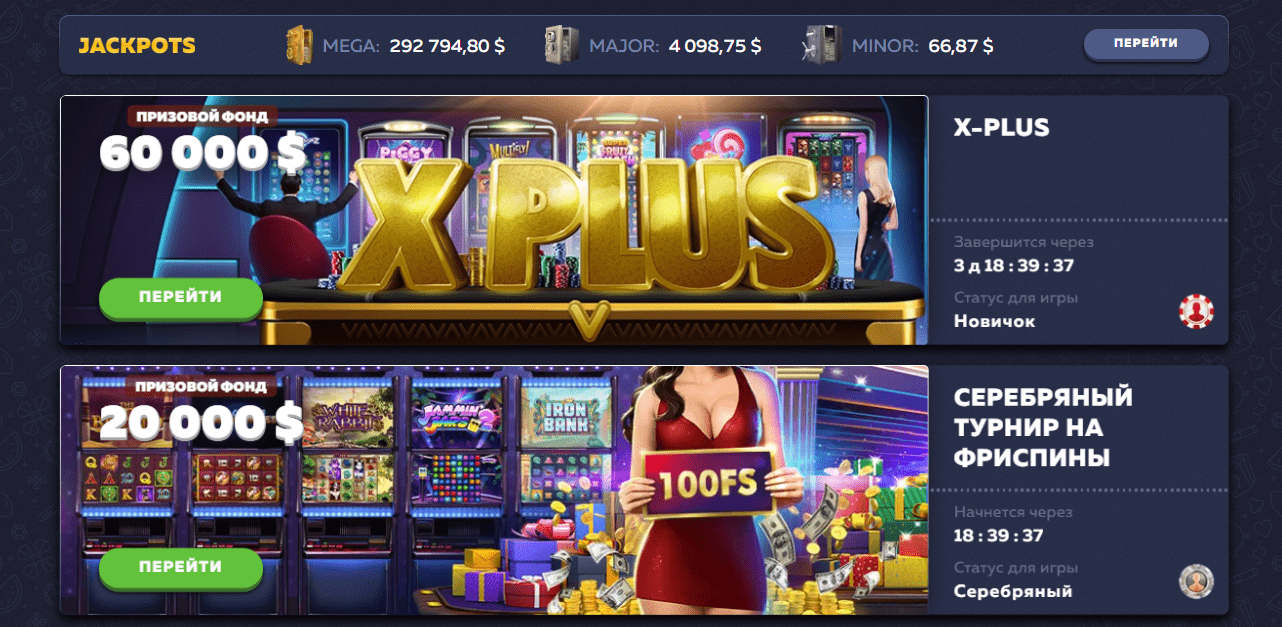

- Получите бонусы (необязательно): Vavada Casino часто предоставляет бонусы и акции для своих игроков. Проверьте страницу акций или раздел бонусов вашего аккаунта, чтобы узнать, есть ли какие-либо доступные предложения. Если вы соответствуете требованиям, вы можете получить бонус, следуя указанным условиям и положениям.

- Выберите игру: Vavada Casino предлагает широкий выбор игр казино, включая слоты, настольные игры, игры в живом казино и многое другое. Просмотрите категории игр и выберите ту, которая вас интересует.

- Установите ставки: Прежде чем начать игру, вам нужно установить ставки. Настройте номинал монеты, уровень ставки или общую сумму ставки в соответствии с вашими предпочтениями и бюджетом. Убедитесь, что вы играете ответственно, и установите лимиты, чтобы избежать перерасхода средств.

- Начните играть: После того как вы установили ставки, нажмите на игру, чтобы начать играть. Следуйте правилам игры и инструкциям, чтобы понять цели, выигрышные комбинации и бонусные функции. Наслаждайтесь игровым процессом и попытайте удачу, чтобы выиграть деньги.

- Обналичивайте свои выигрыши: Если вам повезло и вы выиграли деньги, играя в Vavada Casino, вы можете запросить вывод вашего выигрыша. Процесс вывода может отличаться в зависимости от платежного метода, который вы использовали для внесения средств. Следуйте инструкциям, предоставленным казино, чтобы обналичить свой выигрыш.

- Ответственный подход к азартным играм: Важно помнить об ответственном подходе к азартным играм. Установите лимиты на депозиты, проигрыши и время, проведенное за игрой. Играйте только на те деньги, которые вы можете позволить себе потерять. Если вы чувствуете, что ваши азартные привычки становятся проблематичными, воспользуйтесь инструментами ответственного гемблинга, которые предоставляет Vavada Casino, такими как самоисключение или ограничения на игровой процесс.

Всегда обращайтесь к правилам и условиям Vavada Casino, чтобы узнать о конкретных правилах, требованиях и рекомендациях, связанных с игрой на деньги на их платформе.

Способы пополнения счета в казино Vavada

- Кредитная или дебетовая карта: Vavada Casino принимает депозиты, сделанные с помощью основных кредитных и дебетовых карт, таких как Visa, Mastercard и Maestro. Чтобы сделать депозит, просто введите данные своей карты на странице оплаты.

- Электронные кошельки: Vavada Casino поддерживает такие популярные электронные кошельки, как Skrill, Neteller и ecoPayz. Эти цифровые платежные платформы обеспечивают безопасный и удобный способ внесения средств на ваш счет в казино.

- Банковский перевод: Вы также можете внести средства на свой счет в Vavada Casino с помощью банковского перевода. Просто укажите свои банковские реквизиты, включая номер счета и номер маршрута, и инициируйте перевод через платформу онлайн-банкинга вашего банка или лично посетив отделение.

- Криптовалюты: Vavada Casino принимает депозиты, сделанные с помощью криптовалют, таких как Bitcoin, Ethereum и Litecoin. Если у вас есть криптовалютный кошелек, вы можете перевести средства на свой счет в Vavada, используя указанный криптовалютный адрес.

- Предоплаченные карты: Некоторые предоплаченные карты, например PaySafeCard, можно использовать для пополнения счета в казино Vavada. Эти карты можно приобрести в различных торговых точках и в Интернете, а для внесения депозита достаточно ввести информацию о карте.

- Мобильные платежи: Vavada Casino также предлагает возможность пополнения счета с помощью мобильных платежных платформ, таких как Pay by Phone или Boku. Это позволяет вносить депозиты, используя счет мобильного телефона или предоплаченный баланс.

Vavada casino

100% бонус в казино Кэшбэк 10% 100 Фриспинов в подарокVavada официальный сайт

Vavada casino

100% бонус в казино Кэшбэк 10% 100 Фриспинов в подарокVavada официальный сайт Vavada casino

Приветственный бонус за регистрацию Актуальное зеркало Вход на сайт сейчасВход на зеркало Vavada

Vavada casino

Приветственный бонус за регистрацию Актуальное зеркало Вход на сайт сейчасВход на зеркало Vavada Vavada casino

Бонус до 1000$ 100 бесплатных вращений Бонус в Андройд приложенииЗабрать Бонус Вавада

Vavada casino

Бонус до 1000$ 100 бесплатных вращений Бонус в Андройд приложенииЗабрать Бонус Вавада

Важно отметить, что доступность методов пополнения счета может зависеть от вашего местоположения и конкретных условий Vavada Casino. Поэтому рекомендуем проверить сайт казино или связаться со службой поддержки, чтобы получить самую свежую информацию о методах пополнения счета.

Мобильная версия Vavada

Мобильная версия Vavada — это оптимизированная версия сайта Vavada, специально разработанная для мобильных устройств, таких как смартфоны и планшеты. Будучи онлайн-казино, Vavada признает растущую тенденцию использования мобильных устройств и важность обеспечения бесперебойного и приятного игрового опыта для своих пользователей в дороге. Мобильная версия Vavada гарантирует, что игроки смогут легко заходить на сайт, играть в любимые игры казино, вносить депозиты и выводить средства, а также пользоваться любыми другими функциями и услугами, предлагаемыми Vavada, не выходя из своего мобильного устройства. Это позволяет пользователям наслаждаться игровым процессом в любом месте и в любое время, что еще больше повышает фактор доступности и удобства Vavada как онлайн-казино.

Популярные слоты казино Vavada

Vavada Casino известно своим широким выбором популярных слотов, которые привлекают большое количество игроков. Независимо от того, являетесь ли вы поклонником классических фруктовых автоматов или современных видеослотов, в Vavada Casino найдется что-то для каждого. Захватывающие сюжеты, захватывающий геймплей и возможность выиграть крупные призы — эти популярные слоты обеспечивают увлекательный и прибыльный игровой процесс. От таких популярных игр, как Starburst и Gonzo’s Quest, до слотов с прогрессивным джекпотом, таких как Mega Moolah, Vavada Casino гарантирует своим игрокам постоянное развлечение и вознаграждение.

| Starburst | разработан компанией NetEnt, известным поставщиком программного обеспечения в индустрии онлайн-гемблинга | является одним из самых популярных слотов в Leon Casino. Благодаря ярким цветам, увлекательному геймплею и захватывающим функциям он покорил сердца множества игроков. |

| Gonzo’s Quest | разработан компанией NetEnt, ведущим поставщиком программного обеспечения для онлайн-казино. Компания NetEnt известна своей высококачественной графикой, захватывающим геймплеем и инновационными функциями | Этот слот на приключенческую тематику отправляет игроков в путешествие, чтобы найти затерянный город золота. Благодаря уникальной функции Avalanche и возможности получения крупных выигрышей неудивительно, что Gonzo’s Quest стал любимцем поклонников. |

| Book of Dead | Поставщиком слота Book of Dead является компания Play’n GO. Play’n GO — популярный разработчик программного обеспечения в индустрии онлайн-гемблинга | Вдохновленная Древним Египтом, игра Book of Dead предлагает захватывающие впечатления благодаря потрясающим визуальным эффектам и увлекательному сюжету. Возможность выиграть бесплатные спины и функция расширяющихся символов добавляют острых ощущений. |

| Mega Moolah | Провайдером слота Mega Moolah является компания Microgaming, ведущий разработчик программного обеспечения в индустрии онлайн-гемблинга. Microgaming известна своими инновационными и высококачественными играми для казино | известный своими рекордными джекпотами, Mega Moolah — прогрессивный слот, который в одночасье сделал миллионерами многих игроков. Тема африканского сафари и захватывающие бонусные функции делают этот слот обязательным для посещения. |

| Immortal Romance | Игровой слот Immortal Romance разработан компанией Microgaming, ведущим провайдером программного обеспечения в индустрии онлайн-казино. Microgaming славится своими инновационными и увлекательными слот-играми | слот на вампирскую тематику сочетает в себе романтику и сверхъестественные элементы, чтобы создать захватывающий игровой опыт. Благодаря многочисленным бонусным функциям и захватывающему сюжету Immortal Romance продолжает привлекать игроков. |

| Dead or Alive | разработан компанией NetEnt, известным поставщиком игр для онлайн-казино | окунитесь в атмосферу Дикого Запада с помощью слота Dead or Alive. Эта игра с высокой волатильностью дает возможность получить крупные выигрыши благодаря липким вайлдам и функции бесплатных вращений. Это популярный выбор для тех, кто ищет азарта и больших выплат. |

| Bonanza | Провайдер: Pragmatic Play. Барабаны, 6. Линии выплат, Win All Ways. Бонусная игра, Нет. Символы, Wild, Scatter. Множитель, Да. Процент отдачи, 96.51%. | Благодаря уникальной механике Megaways и 117 649 способам выиграть, Bonanza предлагает захватывающий и динамичный игровой процесс. Шахтерская тематика и каскадные барабаны развлекают игроков часами. |

| Vikings Go Berzerk | Провайдер (разработчик слота): Yggdrasil Gaming. RTP (процент отдачи): 96.1%. Волатильность (дисперсия): средняя. | Этот слот предлагает множество захватывающих функций, включая бесплатные вращения, липкие вайлды и сундуки с сокровищами, гарантируя насыщенный игровой процесс. |

| Joker’s Jewels | разработан компанией Pragmatic Play. Pragmatic Play — уважаемый и авторитетный провайдер в индустрии iGaming, известный созданием высококачественных и увлекательных слот-игр | Для любителей классических фруктовых автоматов Joker’s Jewels станет популярным выбором. Благодаря яркой графике и простому геймплею этот слот понравится как новичкам, так и опытным игрокам. |

| Thunderstruck II | создан компанией Microgaming еще в 2010 году | Основанный на норвежской мифологии, Thunderstruck II предлагает визуально ошеломляющий игровой опыт. Благодаря четырем уникальным функциям бесплатных вращений и возможности выиграть большой куш, этот слот стал любимым среди игроков |

Достоинства и недостатки Vavada Casino

Плюсы:

- Vavada Casino предлагает широкий выбор игр на выбор, включая популярные игровые автоматы, настольные игры и живое казино.

- Казино предоставляет заманчивые бонусы и акции, такие как приветственные бонусы, бесплатные спины и предложения по возврату наличных, которые могут улучшить общее впечатление от игры.

- Vavada Casino имеет удобный интерфейс и доступно с различных устройств, включая смартфоны и планшеты.

- Платформа поддерживает множество методов оплаты, обеспечивая удобство и безопасность транзакций для игроков.

- Казино предлагает службу поддержки, которая работает круглосуточно и помогает игрокам решить любые вопросы и проблемы, с которыми они могут столкнуться во время игры.

Vavada casino

100% бонус в казино Кэшбэк 10% 100 Фриспинов в подарокVavada официальный сайт

Vavada casino

100% бонус в казино Кэшбэк 10% 100 Фриспинов в подарокVavada официальный сайт Vavada casino

Приветственный бонус за регистрацию Актуальное зеркало Вход на сайт сейчасВход на зеркало Vavada

Vavada casino

Приветственный бонус за регистрацию Актуальное зеркало Вход на сайт сейчасВход на зеркало Vavada Vavada casino

Бонус до 1000$ 100 бесплатных вращений Бонус в Андройд приложенииЗабрать Бонус Вавада

Vavada casino

Бонус до 1000$ 100 бесплатных вращений Бонус в Андройд приложенииЗабрать Бонус Вавада

Минусы:

- Азартные игры могут вызывать зависимость, и игра в таких казино, как Vavada, может увеличить риск развития проблем с азартными играми или зависимости от них.

- Играя в казино Vavada, можно потерять деньги, поскольку исход каждой игры зависит от случая и удачи.

- В некоторых странах действуют ограничения или правила, касающиеся азартных игр онлайн, поэтому игроки из этих регионов могут не иметь доступа к казино Vavada или не иметь возможности играть в нем.

- Игрокам важно убедиться в том, что они достигли совершеннолетия для участия в азартных играх онлайн, чтобы избежать каких-либо юридических последствий.

- Время от времени на платформе могут возникать технические трудности или сбои, которые могут нарушить игровой процесс для игроков.